Great Tips About How To Sell A Fixed Annuity

Experienced insurance agents:you are an advanced and educated insurance agent / agency owner that consistently pushes the envelope to learn more and utilize our back office as.

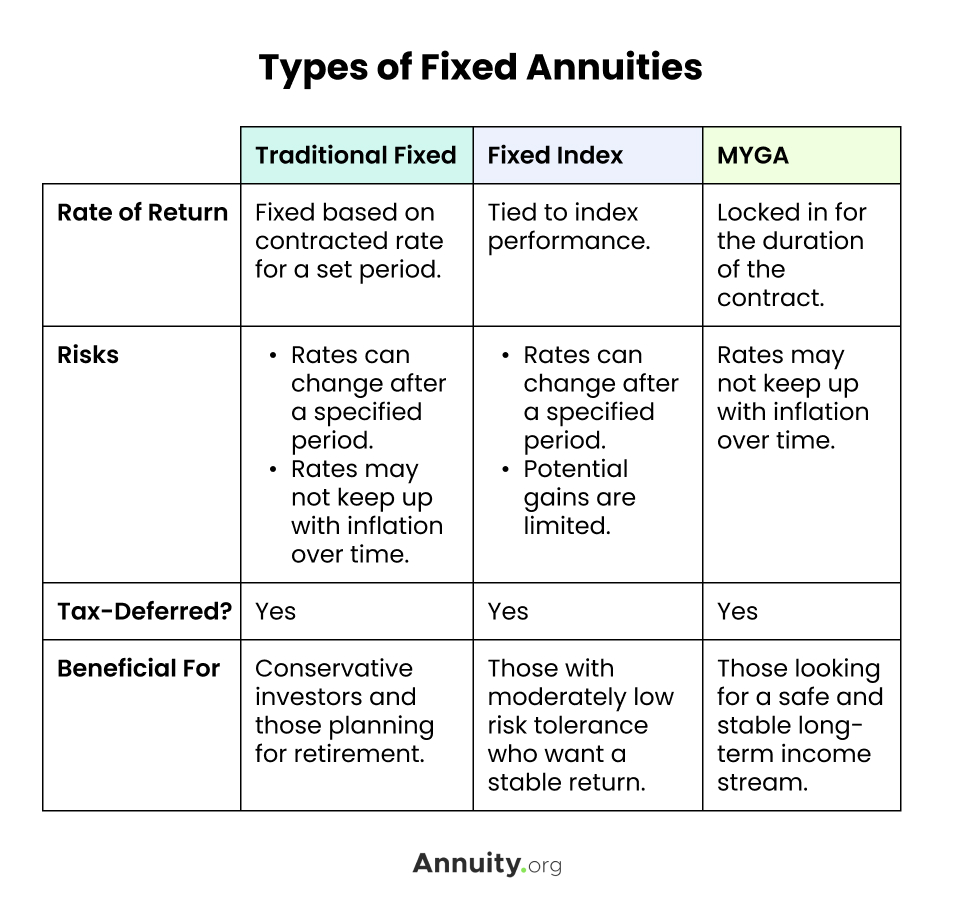

How to sell a fixed annuity. Smith, founder and ceo, clarity 2 prosperity;. How does a fixed annuity compare to other annuities? There are many different types of annuities you can purchase, depending on the kind of risk and reward you’re interested in.

Fixed annuities are among the safest components of a diversified portfolio due to features like guaranteed return of principal (offered on some annuities), tax. Pending the client’s situation, we use annuities with riders for things like income replacement or ltc. Licensing requirements for selling annuities may vary.

If you’re in the market to buy an annuity, be sure to check the agent’s qualifications to sell annuities and that they’re licensed with both finra and your. Advertiser disclosure 10 best fixed annuity rates of february 2024 david rodeck contributor reviewed by rae hartley beck editor updated: What makes an annuity a fixed annuity is how the payouts are structured.

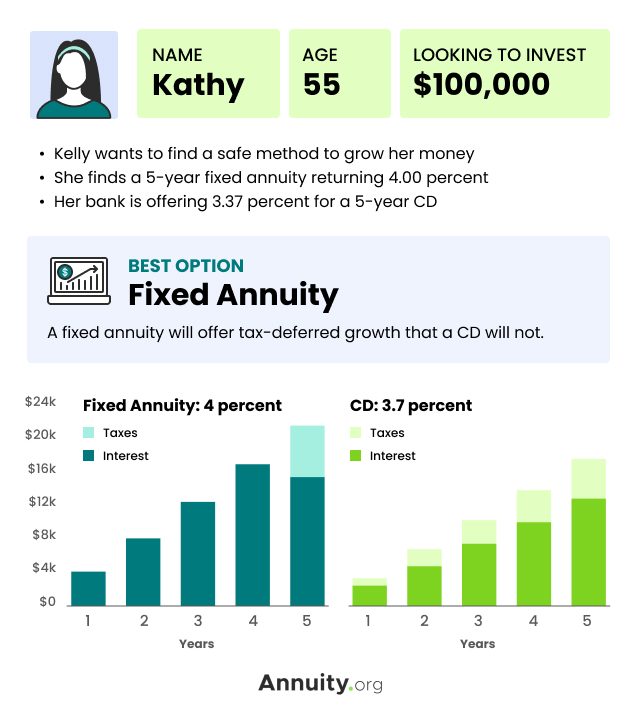

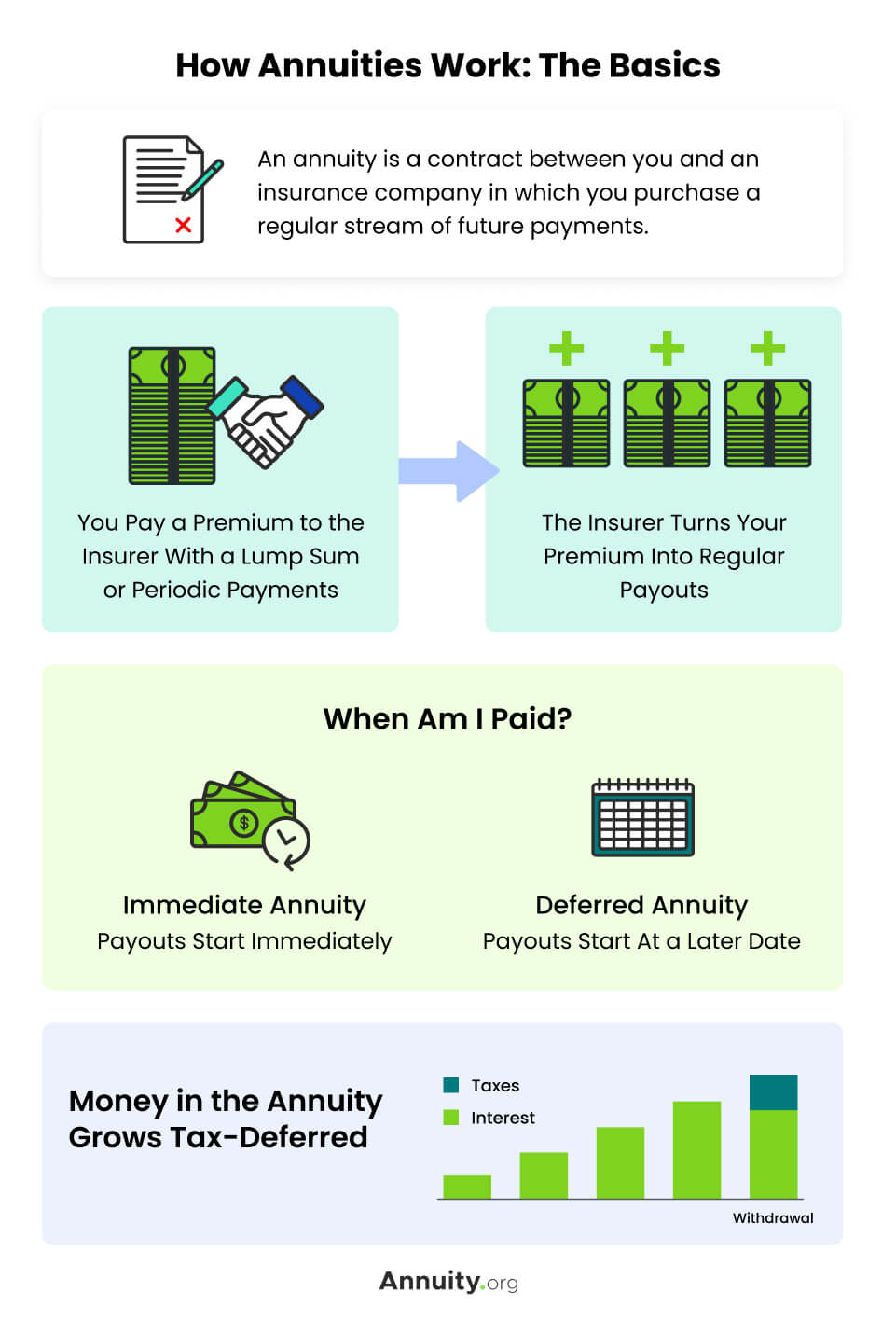

This can be a good option if you need money. Selling an annuity involves transferring the rights to your future payments to a buyer in exchange for a lump sum of cash. A fixed annuity is a type of insurance contract that promises to pay the buyer a specific, guaranteed interest rate on their contributions to the account.

A fixed annuity offers more stability and predictability than other types of annuities, at the cost of. A fixed annuity is a type of insurance product that guarantees a fixed interest rate over a set period of time. How to get a fixed annuity sales license.

Fixed annuities earn a fixed interest. March 21, 2023 explore the world of annuities with our comprehensive guide, covering everything from fixed and variable annuities to selling options and financial. First, you need a life insurance sales license in any state.